By Houze Song

As China’s growth slows, many experts have been speculating on whether China will follow western countries and pursue ultra-loose monetary policy. However, distortions in the Chinese economy are preventing its central bank, the People’s Bank of China, from using the full extent of monetary policy to stimulate the economy. The central bank’s hands are tied, because it doesn’t want to stimulate the economy—and exacerbate a bad debt situation even as it does so. And this explains why, despite all the talk that China will launch its own quantitative easing, we constantly see reports that China’s central bank has not done enough to support the economy.

How could the central bank inadvertently compound China’s debt problems? Though China has successfully tackled many flaws in its economic system and achieved remarkable growth during the past thirty years, its economy is still far from efficient. Oversight of investments made by China’s State-Owned Enterprises (SOEs) and government-affiliated entities is still weak, often leading them to make imprudent and overly optimistic investment decisions. This has already led to a growing debt problem. In the meantime, China’s banks are happy to keep providing cheap credit to the SOEs, believing such loans involve very low risk—a belief that has yet to be proven unfounded.

Without significant reform, the SOEs and local governments will continue borrowing and make unsound investments, while cheap funds will always be available to them. Therefore, a People’s Bank of China stimulus effort might on the one hand be successful in spurring economic growth, but on the other hand encourage more irresponsible lending.

There is not much China’s central bank per se can do to tackle the problem of moral hazard in bank lending. Central banks in general control short-term interest rates, which are usually tightly linked to the interest rate on risk-free assets. But the central bank can do little to influence how much lending banks should charge their borrowers (China abandoned lending rate controls in 2013). The solution to the above-mentioned moral hazard problem is to convince the market that Beijing will not come to the rescue when an SOE or a local government is about to default. But this is beyond the People’s Bank of China’s domain.

As a consequence, the central bank is facing a dilemma. On one hand, if it expands credit too rapidly, then SOEs and local governments will be able to finance their investments at artificially low costs (because of the low risk premium), leading to continued excessive investment. Alternatively, the central bank could maintain interest rates at a higher level, effectively keeping SOE and local government borrowing in check—but possibly exacerbating the current economic slowdown.

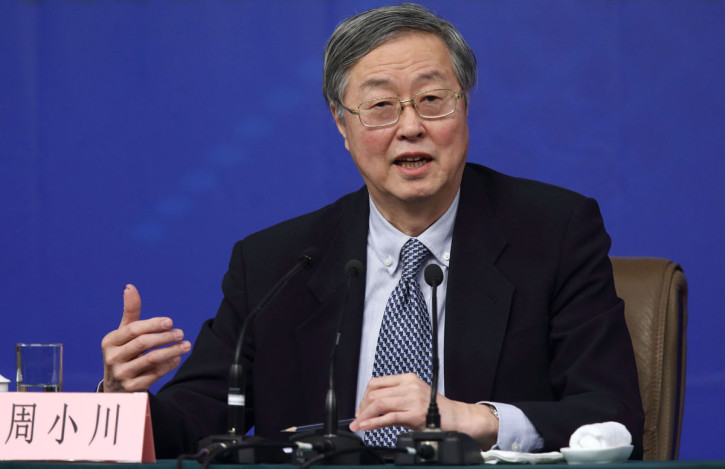

During his speech at the Boao Forum in March, Central Bank Governor Zhou Xiaochuan highlighted this issue and the need for structural reforms. He pointed out that overcapacity sectors are still receiving a disproportionally large percent of credit. Premier Li Keqiang also vowed to adhere to structural reform during a recent interview with the Financial Times.

The bottom line: the People’s Bank of China has to figure out how to use unconventional tools to stimulate the economy without going back to the old credit binge. One such unconventional approach would be to work with China’s policy banks. Following a $62 billion debt equity swap earlier this year, the People’s Bank of China is now effectively a shareholder of China Development Bank and Export-import Bank of China, and China Development Bank enjoys a special liquidity line provided by the central bank. Leaving political controversies aside, whether stimulating credit through policy banks would work better than broad-based credit easing would depend largely on whether these policy banks are able to distribute credit more efficiently than the commercial banks. Beijing seems to believe this will work, and it just promoted China Development Bank bonds to the same class as China’s sovereign bond. The result remains to be seen.

[contentblock id=24 img=gcb.png]