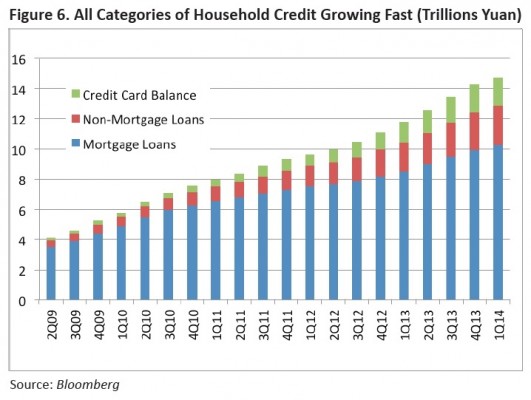

China is striving to transform its economy, in an attempt to reduce reliance on public investment and exports and develop consumption-driven growth instead. …How do you get the Chinese to consume more? Credit. The problem is, the Chinese traditionally have been averse to borrowing, instead saving their yuan for education, real estate, and healthcare. But a new Paulson Policy Memorandum by Bloomberg economists Tom Orlik and Fielding Chen suggests that China’s younger generation is driving massive change. As this chart shows, China’s households are borrowing at increasing rates, a sign that economic reforms are taking hold. The challenge, according to the paper, will be preventing financial instability caused by dangerously-high levels of household debt—one of the root problems behind the 2008 US financial crisis. Orlik and Chen conclude, however, that Chinese regulators should be able to control credit and implement policy that will foster economic stability without choking growth.

China is striving to transform its economy, in an attempt to reduce reliance on public investment and exports and develop consumption-driven growth instead. …How do you get the Chinese to consume more? Credit. The problem is, the Chinese traditionally have been averse to borrowing, instead saving their yuan for education, real estate, and healthcare. But a new Paulson Policy Memorandum by Bloomberg economists Tom Orlik and Fielding Chen suggests that China’s younger generation is driving massive change. As this chart shows, China’s households are borrowing at increasing rates, a sign that economic reforms are taking hold. The challenge, according to the paper, will be preventing financial instability caused by dangerously-high levels of household debt—one of the root problems behind the 2008 US financial crisis. Orlik and Chen conclude, however, that Chinese regulators should be able to control credit and implement policy that will foster economic stability without choking growth.

Are the Chinese Becoming Borrowers?

January 15, 2015