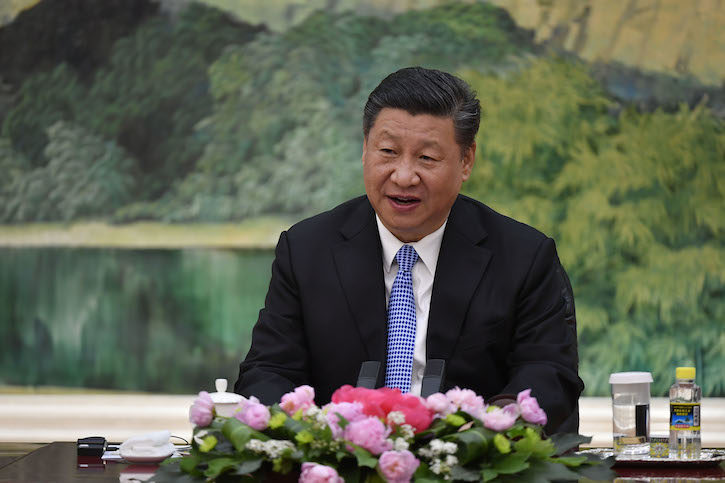

With environmental protection being one of the three “big challenges” identified by the Chinese government as a top priority to address in President Xi’s second term, a robust green finance mandate becomes all the more essential. In an important speech at the National Ecology and Environmental Protection Conference last month, Xi laid out a broad vision for China’s green development and directed Chinese ministries to develop plans to support this vision. It is clear that the bureaucracy is reacting quickly; the challenge will be in ensuring results.

Without developing a mix of private and public sector financing, the government will be limited in its ability to finance many of the necessary changes required to “green” China’s economy. Furthermore, market mechanisms, combined with government policy, are essential for ensuring the rapid transition from a high carbon producing economy to energy efficient growth.

China intends to commit significant resources, Xi said, to ensuring sustainable economic growth. The government will amend its economic and energy plans to promote more sustainable industries, improve the establishment of factories and their locations to avoid polluting soil and water and “foster and expand” industries that support low carbon or environmentally friendly-industries and technologies.

Already, we have seen Chinese ministries move to support Xi’s vision. The China Securities Regulatory Commission (CSRC), for example, has announced that it will expand its work in green finance. The CSRC has stated that it will expand requirements for firms intending to list on China’s exchanges to meet stricter standards for being environmentally friendly, as well as establish environmental compliance and risk disclosure requirements for firms already listed on the exchanges. Unlike in the U.S. where disclosure is voluntary and thus quite limited, Chinese firms will be required to share this information.

The regulator will also seek to work with “green” firms to encourage them to use capital markets as a means to finance additional growth of their business. And the CSRC is exploring the use of other market based mechanisms to promote green development, including the launch of a futures trading system for carbon as part of the establishment of China’s the national carbon exchange last December.

The newly created Ministry of Ecological Environment (MEE) has also recognized the crucial role that green finance has to play. The MEE is collaborating with the CSRC to develop futures trading market for carbon under the national carbon market. Similar to the carbon market, the Ministry is also exploring how to price pollution of the air, water, and soil and establish trading systems for these resources.

The Ministry of Natural Resources (MNR), another newly established ministry, has also made green finance a core part of its mission. The Ministry is creating an office of green finance to explore public private partnerships as well as develop policies around innovative market tools to better protect natural resources. It will seek to place a price on natural resources as a means to use market mechanisms to reduce pollution.

President Xi noted in his speech last month that, “The green finance system is critical in guiding resources to green industries.” As the world’s largest emitter of carbon, it is only through this aggressive combination of government policy and market mechanisms that China will be able to reduce its emissions in a timely manner. And it may prove to the world that it is possible to make the transition to a low carbon economy while still generating strong economic growth.