By Anders Hove

China’s solar energy industry has registered astonishing growth, with 34 GW of new solar installed in 2016 alone, double the amount added in 2015 and more than double the new solar added in the United States. Renewable energy, including solar, is essential for meeting China’s energy and climate goals and reducing reliance on high-emissions coal, which contributes to both air pollution and climate change. China began promoting solar as part of a manufacturing strategy a decade ago, and in recent years has begun promoting widespread uptake of the technology. But the energy produced by solar still accounts for only a tiny share of China’s electricity—in part because of a focus on adding new capacity, as opposed to doing a better job of integrating the energy solar produces, such as through improving power sector operations or locating solar closer to where people live and work.

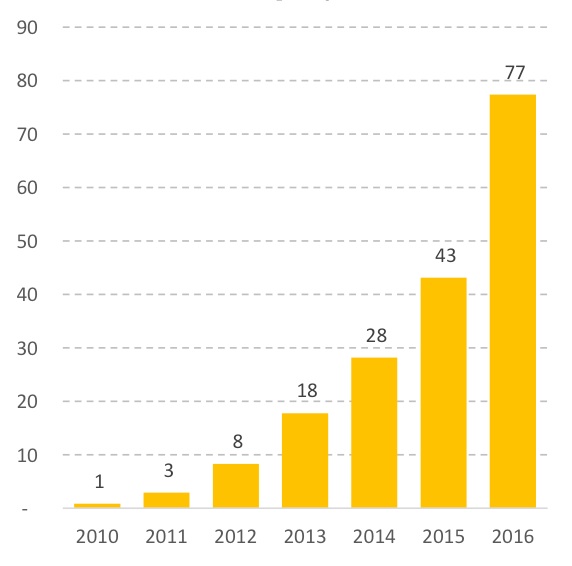

Solar Photovoltaic Power Capacity in China, 2010-2016, in Gigawatts

And so the media, renewable energy investors, and clean energy advocates were watching for signs of change in China’s recently published new five year plan for the development of solar energy. When the plan was announced in December, the market’s reaction was disappointment: the new 110 gigawatt national solar capacity target for 2020 was 27 percent lower than earlier expectations set by officials of 150 gigawatts.

But the media and experts may have missed the point. Observers tend to fixate on capacity targets and gloss over important aspects of the plan: efforts to promote distributed solar energy, data transparency, and power market reform. In the past few years, utility-scale solar has roared ahead, but distributed solar has expanded more slowly, for a variety of reasons including subsidy payment difficulties, red tape, and reluctance of developers to build solar when they won’t benefit from the electricity it produces. Yet distributed solar energy has long-term advantages over utility-scale solar energy, which may be located far from where people live and require costly transmission upgrades.

Also often overlooked is the issue of energy production from solar, as opposed to construction of new solar power capacity. Under the plan, solar electricity production would rise from 40 TWh in 2015 to 150 TWh in 2020.

Targets for solar capacity, just like those for wind capacity, are not as important as the Five Year Plan’s calls for new rules and regulations that could encourage and drive the solar industry in the future.

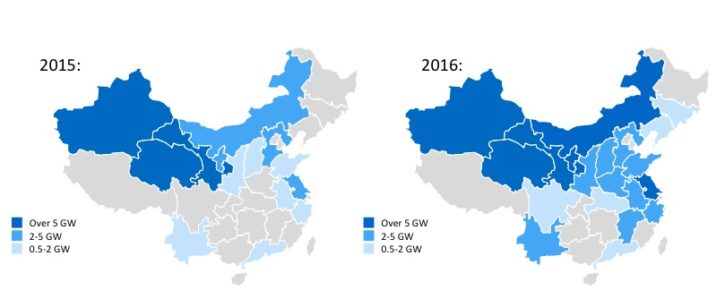

In fact, China’s 13th Five-Year Plan for solar in some ways sets out a more challenging path for China than a higher capacity target would have. Moving the electricity sector in a cleaner direction is much more complicated than simply building more solar farms. One problem is wastage: A large portion of the electricity that wind and solar energy produce is curtailed, or wasted, due to insufficient transmission, economic barriers to trading electricity between provinces, and contractual guarantees given to state-owned coal power producers that leave little room for the electricity produced by wind and solar. For these reasons, China needs to accelerate power market reforms that prioritize the use of renewable energy, while also shifting development of renewable energy to provinces with greater internal power demand. Both of these elements are addressed in the 13th Five-Year Plan, which calls for accelerated power reform while also setting aggressive targets for solar additions in China’s populous coastal provinces while setting no targets for remote provinces with over-built solar capacity like Xinjiang and Gansu in West China. Indeed, NEA data for 2016 show that those more populous eastern provinces are starting to show robust growth, and started to catch up with remote provinces in West China.

China Solar Photovoltaic Capacity by Province in 2015 and 2016 Shows More Populous Eastern Provinces Finally Catching Up

Driving distributed solar

The new solar Five Year Plan could encourage the development of more solar power closer to end users. To date, large-scale, utility-type solar energy has registered robust growth—but much of that is far from population centers. The challenge is to encourage distributed solar, smaller installations closer to cities, including rooftop solar and ground-mounted solar plants that can be large enough to power a small village. Distributed solar is more efficient in the long run because its power can reach customers without expensive transmission or changes to national or regional power system operations.

As I’ve previously described in Cleantechnica, distributed solar in China has been hampered by multiple factors, including difficulty obtaining subsidies and financing, red tape around taxes, and lack of interest from developers. For these reasons, distributed solar accounts for just 7 GW of China’s 77 GW total.

One important step that will drive the development of distributed solar power is the creation of 100 new distributed solar districts, in which 80% of new buildings would have solar panels installed. One of the biggest obstacles to distributed solar power is getting developers interested in including solar in plans for the huge new cities and developments needed to accommodate growing urban populations. The new policy may encourage developers to pursue solar by making solar power a prerequisite for granting development rights. The plan states that the government—including state-owned enterprises, which handle the lion’s share of new construction—should take the lead in implementing such development plans.

Promoting innovation

Also often overlooked due to the focus on capacity numbers is technology innovation, which is critical for China as it seeks to retain its dominant manufacturing position as other low-cost developing countries like India ramp up their solar industries. In the U.S., China’s solar industry has an undeserved reputation as a tech laggard; in fact, several Chinese firms have made headlines for record-breaking solar conversion efficiencies—the rate cells convert energy from sunlight into electricity. Trina Solar, for example, in 2016 announced a 22.6% efficient PERC (passive emitter rear cell) cell. The 13th Five-Year Plan explicitly calls out some of the technologies that Chinese firms have already begun to implement, such as PERC and N-type silicon, while also broadly mentioning thin-films as a promising area for development. By including these technologies in the plan, the government has earmarked these areas for future growth and investment, indirectly signaling that weaker players that can’t keep up with cutting-edge technologies may eventually be weeded out. This in turn frees up resources for cutting-edge technologies—which could be critical to the sector’s future globally if the U.S. government begins to scale back funding for clean energy technology R&D.

Power market reform

The most critical element for speeding solar deployment in China is power sector reform, and this 13th Five-Year Plan document could help speed such measures. For example, the new solar plan includes priority dispatch for clean energy, platforms for direct trading and purchase of energy from solar plants, and integrated planning of solar in construction of local and regional power grids. Many customers, including large commercial and industrial players with corporate renewable energy targets, are eager to purchase more solar energy, but this is difficult in the absence of a clear market mechanism for doing so. Advancing direct trading and improving priority dispatch of renewable energy will help.

China’s low-cost manufacturing capability, huge land area, and reasonably abundant sunlight make it likely that the solar power sector can continue to grow, if barriers can be overcome. Today, the obstacles are less related to government capacity targets and more to business models for distributed solar and electricity market reforms that can enable renewable energy’s benefits to be more widely shared. There is plenty in the new Five Year Plan to suggest that China is still on the path to move forward aggressively with solar energy, helping to turn this clean energy source into a larger share of the country’s overall energy mix, and as a result reducing pollution and climate change emissions.

Anders Hove is Associate Director of Research at the Paulson Institute.