By Anders Hove and David Sandalow

Natural gas plays a small but growing role in China’s energy sector. As part of its campaign to clean the air in China’s cities, the Chinese government has adopted a range of policies to promote natural gas, which produces a small fraction of the local air pollutants and just half the carbon emissions as coal per unit of energy. These policies may create opportunities for new cooperation with the United States—now the world’s leading producer of natural gas.

What role does natural gas play in China’s energy portfolio?

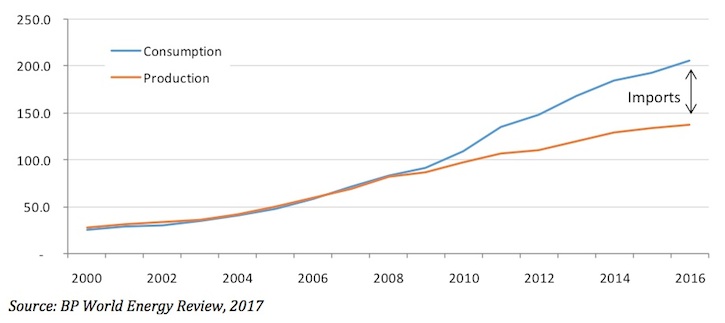

Natural gas currently supplies 6% of China’s energy, far below the world average of 24%. China’s natural gas consumption has risen steadily over the past decade, from 47 billion cubic meters (bcm) in 2005 to over 200 bcm in 2016. (One billion cubic meters per year is equal to roughly 0.1 billion cubic feet per day.) In the first half of 2017 demand grew 15% versus the year prior.

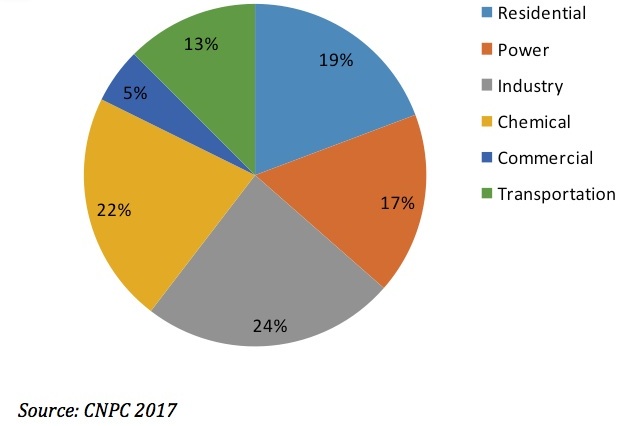

Unlike in the U.S., where power and residential consumption dominate gas demand, in China demand is spread across multiple sectors. Of these, the largest are industry and chemicals, accounting for 24% and 22% respectively. Power and residential, which make up 17% and 19% of demand respectively, are growing more rapidly, however. China National Petroleum Corporation, China’s largest integrated energy company, projects that residential consumption may double and power consumption may triple by 2030. LNG is also used in the trucking sector as a substitute for heavily polluting diesel.

China natural gas consumption by end-use sector, 2015

Where does China get its natural gas?

China’s domestic natural gas production has increased from around 50 bcm in 2005 to over 120 bcm in 2016. Production is mostly from conventional onshore sources, but the Chinese government is looking to offshore conventional gas, coal mine methane (CMM), coal bed methane (CBM) and shale gas for increased production. China National Petroleum Corporation estimates that by 2020 conventional gas production will rise to 170 bcm, while shale gas and coal bed methane output will each rise to 20 bcm from 4 bcm in 2015.

Until 2010, China met gas demand mainly from domestic production. Today, however, a large and growing fraction of China’s natural gas supplies come from abroad.

Imports met approximately 35% of China’s gas demand in 2016, and could surpass 50% by 2020. In 2016, China’s gas imports were approximately evenly split between pipeline and LNG sources. Today China imports gas by pipelines from Turkmenistan, Kazakhstan, Uzbekistan and Myanmar. The Chinese government is working to expand pipeline imports, with a new 38 bcm per year pipeline from Russia, called Power of Siberia, projected to begin operations in 2019 (although in the past pipeline imports from Russia have faced delays due to complex negotiations over prices). The two countries are in discussions over several potential new pipeline routes as well.

While China is boosting domestic gas supply from both conventional and unconventional sources, and adding new pipeline capacity from Russia, current market forecasts from CNPC and consultancy SIA show a continued supply gap that will likely be filled by liquefied natural gas (LNG) imports. China’s rising LNG imports are growing rapidly. China posted by far the largest rise in LNG imports of any country last year and is now the third largest importer of LNG worldwide, behind Japan and South Korea. More than a dozen LNG import terminals have been built along China’s coast and several more are under development. Chinese companies have financed upstream LNG capacity in countries such as Qatar and Australia. China received 46% of its LNG imports from Australia in 2016. Recently, the U.S. became a supplier of small amounts of LNG to China.

China natural gas consumption and production, 2000-2016, billion cubic meters (bcm)

How much is China’s natural gas supply and consumption expected to increase?

China recently reaffirmed plans to source 10% of energy consumption from gas by 2020—the high-end of an earlier range established by the 13th Five-Year Plan—and reach 15% by 2030. CNPC forecasts that gas consumption will rise to 440 bcm and possibly as high as 520 bcm by 2030, which will require extensive expansion of the nation’s natural gas infrastructure. The country plans to build out its domestic pipelines from 64,000 km (40,000 miles) in 2015 to 104,000 km (65,000 miles) by 2020, boost underground gas storage by nearly a factor of three, and raise domestic production from 135 bcm in 2015 to 207 bcm in 2020.

What types of natural gas policies is Beijing enacting?

Natural gas pricing reforms are a crucial part of the government’s efforts to allow markets to play a decisive role in the allocation of natural resources. Gas prices for non-residential customers were liberalized starting in 2015. In 2016 China also reformed pipeline pricing, granting a flat 8% return on investment for inter-provincial pipelines and promoting transparency in pipeline costs. In 2016 the doors opened at the new Shanghai Petroleum and Natural Gas Exchange and subsequently at the Chongqing Petroleum and Natural Gas Exchange, boosting competition. After the 2017 National People’s Congress, the government announced a further reform that will grant third-party access to pipelines and LNG import terminals, a measure expected to further increase demand for LNG.

Beijing is also supporting demand growth on the ground with administrative and market-oriented policies, especially through conversion of heating and industrial users from coal over to gas. In the Jing-Jin-Ji (Beijing-Tianjin-Hebei) region, home to more than 100 million people, vast semi-rural regions that had relied on heating from low-quality coal are being converted to natural gas or electricity. Of the heating demand replaced under this policy, gas will provide 84% and electric heating just 16%. For many areas, the deadline for completing conversion is winter 2017. The provinces of Shandong, Henan, Shanxi, and Sichuan are also subsidizing conversion of rural and urban heating from coal to gas.

Is China experiencing a shale revolution similar to the US?

By some estimates, China has the world’s largest shale gas resource, but development of China’s shale has proceeded slowly despite early hopes it could replicate the success of the U.S. in this field. China initially set a target to develop 60-100 billion cubic meters of shale by 2020, but in 2014 cut this target to just 30 bcm—and some experts consider even this reduced goal unlikely. Unlike U.S. shale reserves, China’s shale gas is mainly located in deep, heavily folded geological formations, often in inaccessible mountainous regions. While China had drawn on the expertise of international oil services companies, these firms have gradually pulled out, in some cases citing challenging economics under complex production sharing arrangements. A recent paper from the Paulson Institute concludes that under the current natural gas prices and shale well costs, and without private access to mineral development rights, national oil companies are the only players likely to play a role in developing the country’s shale assets.

Can the U.S. become a leading supplier of liquefied natural gas (LNG) to China?

A recent column in Forbes called U.S. exports of LNG a “game changer” and some others have put forward a bullish case for sending low-cost U.S. natural gas to China. The recent expansion of the Panama Canal has reduced the time and cost for sending LNG to Asia from the Gulf Coast, where several U.S. gas liquefaction ports are under development. Since sending the first cargo of LNG to China’s Shenzhen in July 2016, Cheniere, the first company to begin exporting LNG in significant volumes from the continental U.S., has now sent at least 10 cargoes to China. However, the U.S. share of China LNG imports is still small. Most of China’s LNG is sourced from Qatar and Australia under long-term contracts, while U.S. cargoes delivered have so far been spot trades.

The Chinese government has a long-term strategy to diversify its natural gas imports and invest in upstream gas supplies through long-term contracts and equity investments. Increasing imports from the U.S. could serve multiple Chinese policy objectives. Qatar has recently faced geopolitical instability, though supplies have been stable. Australia’s LNG projects have experienced high capital costs, and recently there have been calls to restrict gas exports due to domestic power shortages. The U.S. government has recently promoted LNG exports as a geopolitical strategy and included long-term LNG contracts as a topic for discussion in the Strategic Economic Dialogue with China. If U.S. natural gas prices along with vessel charter rates, shipping fuel costs and canal fees remain low, U.S. LNG could become increasingly attractive for Asian markets.

Anders Hove is a consultant with the Paulson Institute. David Sandalow is the Inaugural Fellow at the Center on Global Energy Policy at Columbia University and has served in senior positions at the White House, State Department and U.S. Department of Energy.