By Anders Hove

China’s new electricity sector five year plan, released last week, has drawn criticism from the environmental community because of targets for increased coal power capacity and slower growth for renewable power. But as China’s economy adjusts to the new normal, efficiency matters more than capacity as an indicator of how smoothly the clean energy transition is going.

One criticism of the new plan is that it calls for more new coal plants, in spite of existing coal overcapacity and flat power demand. The country’s 2020 targets for coal capacity (1100 GW, an increase from 920 GW currently) imply that additional coal power will come online over the next four years—as much as 45 GW per year, though some old capacity will be retired. The new goals seem to contradict policies that call for many provinces to cap coal consumption and for large areas of China to be classified as red lines, where new coal plants should be limited or prohibited. Meanwhile, with some 200 GW of coal capacity already greenlighted or under construction, the National Energy Administration has said that staying under the new, higher 2020 coal power target will be a challenge.

A second criticism is that the plan calls for lower than expected additions of clean energy. The plan sets a slower growth rate for new wind and solar capacity. Originally, plans for 2020 called for solar PV to rise to 150 (up from around 65-70 GW today), but the new plan lowers the 2020 target to 110 GW. Similarly, original plans had suggested China’s 2020 wind capacity would rise from around 150 GW of wind today to 250 GW, but the new plan lowers the 2020 target to 210 GW.

But let’s not overreact: the key to reducing carbon emissions is how energy is actually produced, not numbers of new plants. Focusing on capacity made sense during the country’s period of rapid industrialization, when shortages in electricity could emerge very quickly and China’s state-owned power sector needed to be pushed forward aggressively to meet the economy’s immense and growing need for power. The rush for capacity in renewable energy also helped scale up wind and solar, helping these technologies mature and fall in cost.

As disappointing as higher coal capacity targets may seem, it’s important to note that China’s slowed economic growth, along with its transition to a more consumer- and services-focused economic model, will have profound impact on actual energy use—whatever the capacity may be.

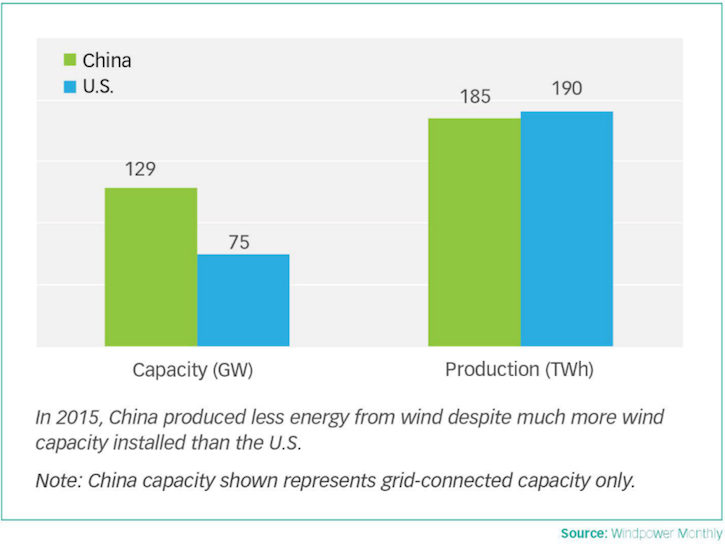

Today, as China’s economy adjusts to the “new normal” of slower growth, what matters more than capacity is efficiency, often at a provincial or regulatory level. Because of poorly coordinated development and distribution, as well as misaligned incentives, China wastes as much as 20% of the clean energy it could produce. The good news in China’s new five-year plan is that it sets a clear quantitative target for reducing wind wastage, called curtailment, below 5% by 2020. Paulson Institute research has highlighted ways to boost renewable energy efficiency and achieve such targets. In particular, the “Going for Gold” report examines successful policies in Texas and Germany to address renewable integration challenges—setting such goals and timelines for renewable integration is a positive step.

Finally, what’s needed now are clear plans and better agency coordination to integrate all of China’s energy sources together in an efficient, market-driven whole. Recent months have seen a rapid roll-out of bilateral power trading pilots, new regional power trading centers (including in the Beijing-Tianjin-Hebei region), and efforts to develop spot markets for renewable energy. Next year, China is expected to begin carbon trading at a national scale for large State Owned Enterprises, and environmental taxes for smaller emitters. Inherently, these policies are complex and difficult for the market to understand. Nevertheless, under China’s “new normal,” capacity numbers and targets may be the least important indicator of how smoothly the clean energy transition is working. In the meantime, China can do more to clarify how its various energy-related agencies, targets, and policies will work together to speed the clean energy transition.

Anders Hove is Associate Director of Research at the Paulson Institute.