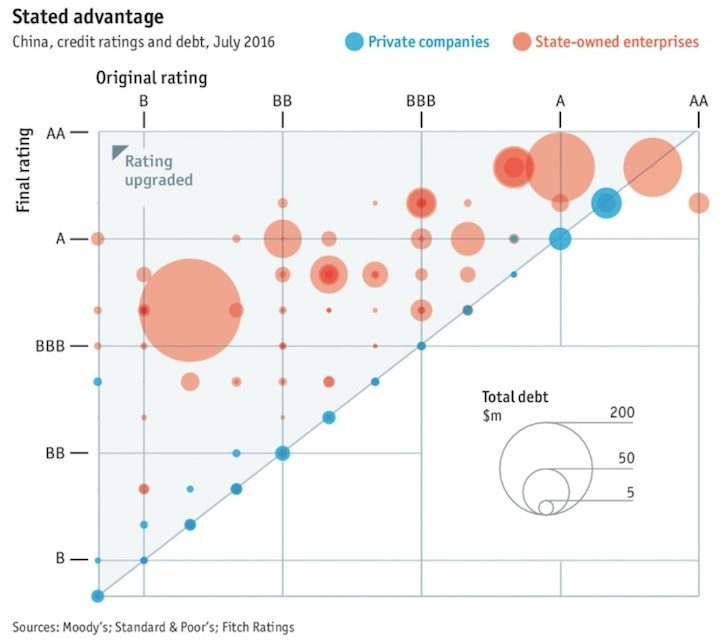

According to this chart, state-backed Chinese companies (represented in orange) tend to receive inflated credit ratings, even despite sometimes enormous debt, compared to private companies (in blue.) The ratings, in turn, help state-owned enterprises (SOEs) gain access to cheap financing, according to research from The Economist. So what? The phenomenon reflects a problem that, according to Tsinghua University professor Zhu Ning in a recent Paulson Policy Memorandum, is a long-term drag on China’s economy: moral hazard. What that means, he writes, is that Beijing provides an implicit guarantee against insolvency, resulting in state-backed lenders and borrowers with little aversion to risk. With these guarantees, SOEs may take more risks, potentially threatening the long-term stability of China’s economy. To combat this issue, Zhu writes, China must take steps to allow market forces to rebalance the economy. Among his prescriptions: a gradually liberalized capital market account, security market reforms, and more bankruptcies to signal risky investments are no longer guaranteed. If market reforms can gain traction, SOE credit ratings might then fall in line.