In the highly competitive pharmaceutical industry, contract research outsourcing (CRO) has emerged as a popular business model. Seeking to gain an international presence, Jiangsu-based WuXi PharmaTech (WX) spent $163 million to acquire AppTec, a U.S.-based pharmaceutical research firm. A new Investment Case Study from the Paulson Institute think tank takes readers inside the deal, illustrating important lessons for future Chinese acquisitions in the U.S. Five key takeaways:

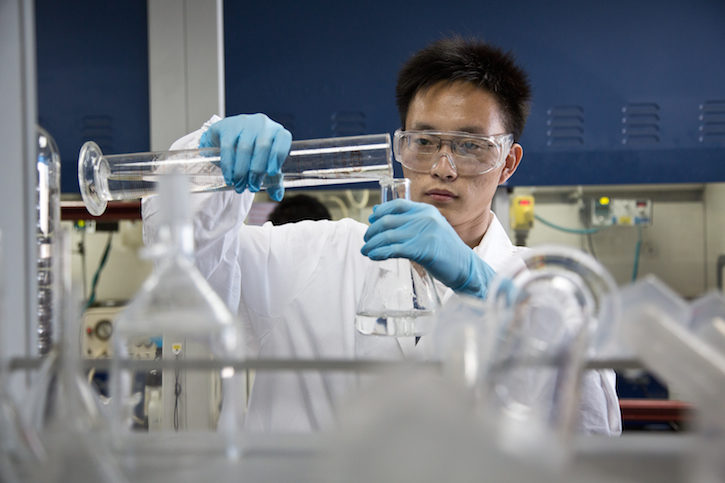

- Declining revenue streams and mounting costs for drug development have led drug companies to search for innovative ways to cut costs. They have been able to accomplish this by looking to small, nimble and focused companies to execute specific stages of the drug development process. This is known as Contract Research Outsourcing (CRO), which has seen a boom in the last two decades or so because of the increased cost pressure on large pharmaceutical companies.

- Competition in the CRO sector has been intensifying, leading many CROs to build integrated suites of services to remain competitive. WuXi Pharmatech was an example of such a CRO, and its acquisition of AppTec in the U.S. was primarily motivated by the prospects of acquiring new testing capacity.

- Companies based in China have been able to engage in “talent arbitrage.” The arbitrage results from leveraging the abundant supply of new biology and chemistry PhDs who have been pouring out of Chinese universities, which has resulted in substantially lower labor costs.

- Management looking for international acquisitions should pay close attention to macroeconomic indicators and future growth forecasts. WX’s acquisition of the U.S.-based AppTec was derailed by harsher macroeconomic conditions and the subsequent pressure this put on Apptec’s revenue streams.

- Chinese companies can gain prestige and international rapport by branding themselves as “global” companies after an international acquisition. In WX’s case, the AppTec acquisition was appealing partly due to the credibility it would gain as an international company (as opposed to a “Chinese” one).