By Houze Song

Chinese investment in the United States has become increasingly controversial and is deeply intertwined with American politics. But while a growing chorus in the United States is calling for new restrictions on Chinese direct investments (FDI), it is, ironically, domestic constraints within China that may play a more important role in reducing the scope and pace of Chinese activity in the U.S.

Many observers, including vocal opponents of Chinese direct investment, have simply presumed that it will continue to grow at its recent rapid rate. However, a closer look at China’s balance of payments data shows that Chinese overall direct investment overseas may well have topped out. What’s more, there is little evidence that Chinese investors disproportionately overweight U.S. assets.

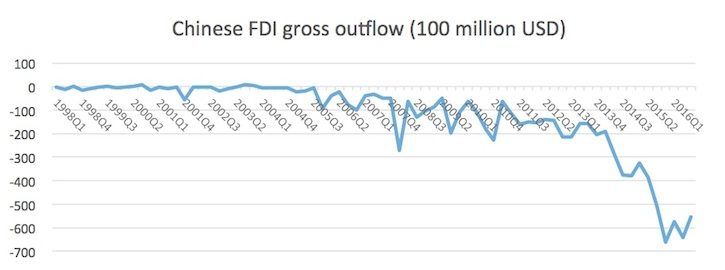

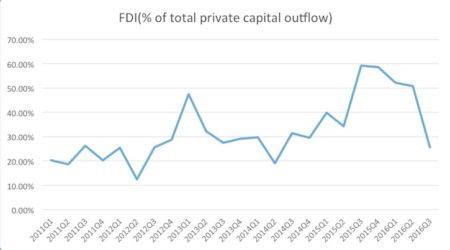

The recent surge in Chinese FDI is attributable, in part, to the simple fact that past Chinese FDI has been abnormally low (see Figure 1). For more than a decade, China has run one of the world’s largest trade surpluses. The flip side of a trade surplus is capital outflow (since foreign currency revenue usually gets invested in financial or real assets.) Until recently, the large amount of Chinese capital outflow had been principally in the form of U.S. government debt. This was due both to China’s exchange rate policy and its control on private capital outflows. Until very recently, therefore, China’s direct investment only accounted for a small percentage of China’s total gross capital outflow. Before the financial crisis, in most years, FDI only accounted for less than 5% of the country’s total capital outflow. And even within the category of “private” capital outflows (“private” here includes everything besides reserve assets), China’s FDI accounted for less than one-third of capital outflow until 2015. One-way appreciation of the yuan made investment abroad even less appealing for Chinese investors.

Chinese FDI: Is the growth trend slowing?

Still, over the past decade, Chinese investors have gradually increased the weight of FDI in their foreign investments. The depreciation of the yuan after mid-2014 accelerated this process. As a result, private capital outflows now account for the majority of Chinese foreign investment, overtaking the Chinese central bank’s investment in, for example, foreign debt instruments. FDI as a share of total foreign investment has also increased. As a result of this double boost, China’s total annual FDI reached $187.8 billion in 2015, up from $123.1 billion in 2014, and continued to grow last year. By the end of the third quarter of 2016, China’s annual FDI had already reached $176.7 billion.

This helps explain why Chinese FDI in the United States also surged during the past few years. Chinese FDI in the United States reached $45.6 billion in 2016, according to the consultancy Rhodium Group, whose estimates are on the higher end among those who attempt to measure Chinese FDI in United States. Although we do not know the number for China’s total 2016 FDI yet, Chinese FDI in the United States doesn’t seem to be disproportionate with its investments elsewhere in the world: investments in the United States most likely accounted for less than a quarter of total Chinese FDI worldwide. Given that the United States accounts for about a quarter of world GDP, the increase of Chinese FDI into the United States simply reflects the overall surge in Chinese FDI globally.

But that may now change. Going forward, there is not much reason to expect China’s total FDI to continue to grow at the current rate. China’s gross private capital outflow is already much larger than its current account surplus and capital inflow combined. So far, this has been made possible by the selling of reserve assets, but this simply cannot continue forever. In addition, FDI already accounts for about 50% of the total acquisition of foreign assets in recent quarters. This ratio probably will also not increase further. No investor wants to put all his assets in illiquid FDI. That is true for a country, too. Finally, China is taking measures to try to control capital outflows—which will also likely further limit FDI.

The bottom line: American political debates about Chinese investment seem set to intensify, but domestic constraints in China are beginning to constrict outbound FDI, and China’s U.S.-bound investments are not likely to be an exception.

[contentblock id=24]