Our Beijing-based Climate Change & Air Quality Program team share what they are reading and talking about

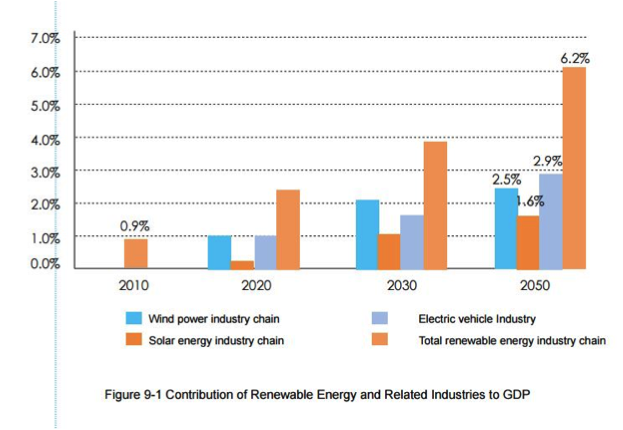

The China National Renewable Energy Centre released a report that argues it is technically and economically feasible for the country to get 85% of its electricity and 60% of total energy from renewables by 2050. Scenario analyses quantify how this shift would contribute to GDP and employment growth, demonstrating one of the Paulson Institute’s central beliefs: that economic prosperity and environmental quality can go hand in hand. The report’s recommendations echo many of those from international and Chinese experts at our September 2014 Air Quality Workshop.

Another noteworthy report, from the Financial Research Institute of the People’s Bank of China (PBOC) and Greenovation Hub argues that China needs to cut lending to coal-related industries and shift financing to cleaner businesses in order to address the county’s air pollution. The Chinese government is aware that finance is a key missing ingredient in steering the transition toward a cleaner economy, and the release of this report only further confirms that. In his book released earlier this year, which will be published in English by the Paulson Institute, PBOC Chief Economist Ma Jun showed that China cannot reach its goals of lowering air pollution without reducing the share of energy-intensive industries and fossil fuel in the country’s economic mix. This report shows that cutting coal-related lending to 40% of the 2013 level would help bring coal consumption down to around 4 billion tons by 2020 – the year that China aims to cap consumption at 4.2 billion tons.

Last week state-owned Baoding Tianwei, a power-equipment manufacturer, announced that it would not make an 85.5 million RMB (US$14 million) interest payment, becoming the first state-owned enterprise (SOE) to default on domestic debt. The news suggested the government’s willingness to let market forces decide the fate of enterprises – an example of Xi’s claims that market forces will play a more “decisive” role in the economy. This week the company reportedly secured a last-minute bail-out loan from China Construction Bank. Does that mean the government has concluded that the company’s survival is important to the system?