By Li Zhu and Terry Townshend

As Beijing hosts the annual ‘two meetings’ (the National People’s Congress and the National Committee of the Chinese People’s Political Consultative Conference) to address the nation’s priorities for the year ahead, one issue that will almost certainly be on the agenda is how to encourage private sector investment in environmental protection.

At the end of 2018, nine Chinese ministries led by the National Development and Reform Commission (NDRC) released an action plan to promote market-based ecological conservation and compensation mechanisms. The action plan represents a major step forward in recognizing and promoting the private sector’s role in supporting environmental protection.

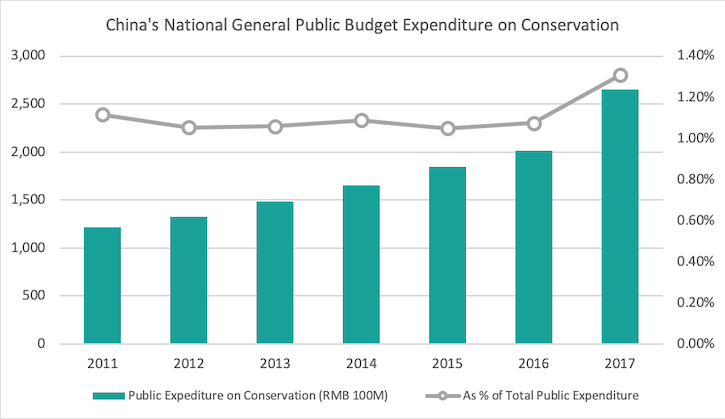

Despite a steady increase in China’s public spending on conservation, there remains a large funding shortfall to meet the investment needed to rectify the environmental degradation of the last few decades. And, as China’s economic growth is projected to slow, the government will likely be hard-pressed to increase investment to the levels required to ensure adequate protection and restoration. Against this backdrop, encouraging the flow of resources from the private sector into ecological protection is a priority for Beijing.

The overall principle of the 2018 action plan is to build a policy environment in which those who benefit from ecosystem services—including the provision of fresh water, water purification, flood control, and food—contribute financially and those who protect, maintain and restore ecosystems are properly compensated.

The action plan identifies nine key tasks for establishing market-oriented and diversified ecological protection compensation, including improving compensation requirements and systems for natural resource development and use, exploring pollutant discharge cap and trade systems, water rights trading, carbon offsetting, ecological agriculture, environmental labeling, green procurement, green finance, and green benefits sharing.

According to Forest Trends, an organization that tracks conservation financing globally, although market mechanisms are beginning to generate resources for conservation, public funding still underwrites the bulk of global conservation efforts. China needs to manage its expectation on the speed and scale of leveraging non-public source funding for conservation.

On the one hand, China has a ‘second mover advantage’ in learning from the experience of other countries where market-based mechanisms have been piloted with varying degrees of success. On the other hand, China’s tendency to prioritize speed and scale could be cause for concern, as could a lack of robust data and other enabling conditions.

Successful market-based mechanisms require forceful and clear policy frameworks, rule-abiding market players, transparency, credible data, and rigorous monitoring. It’s also critical that the ultimate goal of these mechanisms, in whatever form, is to help deliver conservation results. Pursuing these mechanisms for the sake of quantity, scale, and economic returns over quality would defeat the purpose of instituting them in the first place.

Additionally, establishing market-based mechanisms doesn’t mean that the government should take a laissez-faire approach. On the contrary, the government must be an effective rule enforcer. If the global experience is any guide, a thriving market-based mechanism for ecological protection in China will require conservation policymakers and practitioners to work closely with government to design the incentive policies and regulatory parameters within which the mechanism will operate, as well as to be resistant to any attempts to water down top-level targets.

The Paulson Institute is developing case studies that provide international experience on market mechanisms for ecological compensation. In particular, we are exploring the concept of mitigation banking for wetlands. This concept is a mechanism for compensating for unavoidable damage to wetlands caused by economic development activities. Under the mitigation banking system, developers must first try to avoid, and then minimize, any impact on wetlands. For unavoidable damage, developers must pay the cost of replacing the lost ecosystem functions by restoring or creating wetlands elsewhereby themselves or by purchasing mitigation credit from the companies whose business is restoration of the degraded wetlands. In the U.S., this mechanism has grown to become a sizable market and a preferred means for compensating for unavoidable damage to wetlands. According to Ecosystem Marketplace, an initiative by Forest Trends, the wetland mitigation banking industry in the U.S. was worth USD 3.2 billion in 2016, with 1,300 wetland mitigation banks in operation.

A key to the success of wetlands mitigation banking in leveraging private investment and lessening impact on wetlands lies in a comprehensive regulatory framework and policy suite underpinned and guided by the principle of ‘permanent protection’ or ‘protection in perpetuity.’ As a result, great attention has been given to the design of requirements for mitigation bankers to ensure that they put together plans and resources that guarantee the long-term ecological functions of the mitigation banks, and that they do not seek short-term profits at the cost of the mitigation banks’ long-term health and integrity. This emphasis on long-term results is something all policymakers should consider and learn from when deploying market-based mechanisms for conservation.

As the world looks to solve mounting environmental problems at scale, governments and the private sector must work together to harness the power of markets to better preserve and restore our natural environment. The Paulson Institute, by communicating best practices and lessons learned from overseas, is committed to supporting the Chinese government’s efforts to protect its globally significant ecosystems.