The prevailing view on carbon taxes is that they are damaging to economic growth. But in Can Carbon Taxes be Good for China and the United States?, the latest Paulson Paper on Energy and Environment, Antung Anthony Liu argues the opposite: carbon taxes, he writes, would boost economic growth—especially in China. Why? Liu, a fellow at Washington think tank Resources for the Future, argues that carbon taxes increase economic efficiency. How?

- Carbon taxes are much more difficult to evade.

- They lead to less market distortions than other forms of taxes.

- They could help shrink the informal economy and bring people back into the formal economy.

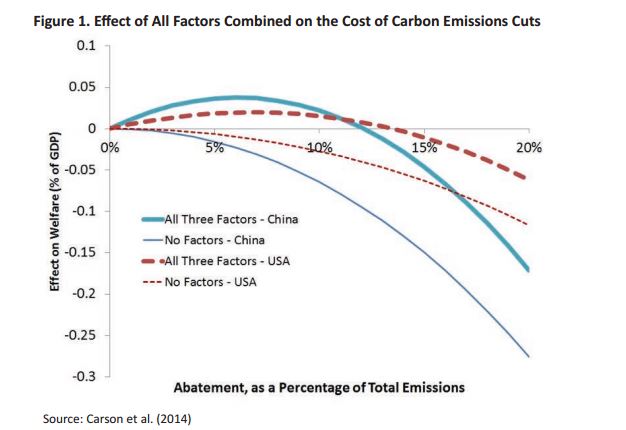

Liu uses a complex economic model to prove his point, illustrated above. All four lines show the impact of a carbon tax. The thick blue line, which predicts China’s economic growth taking into account those above three factors, shows that carbon emissions reduction of up to 12 percent would give the economy a boost.

Why would the impact be greater in China than the United States: China has greater tax evasion (partly solved with a carbon tax), a much more energy-intensive economy (tax would be concentrated in a few sectors with limited distortions on overall market behavior) and a much larger informal sector (which might shrink in response to tax cuts in sectors such as services). What impact does the carbon tax have when carbon emissions are reduced by more than 13 percent? At that point, the picture doesn’t look as positive.

This study certainly won’t be the last word on carbon taxes. Hopefully, it will lead to more research on the economic impact of carbon taxes and bring the debate to the real bread and butter issue of economic costs and benefits to Americans and Chinese.

Read more about how a carbon tax can be good for the economy in Liu’s paper.