In its effort to promote a positive US-China economic relationship, the Paulson Institute co-hosted a US-China CEO Bilateral Investment Dialogue with Goldman Sachs, the US-China Business Council and the China Development Research Foundation. The meeting brought together 21 American and Chinese CEOs, nine mayors, 22 China and trade experts, as well as Secretary of Commerce Penny Pritzker and US Trade Representative Michael Froman, to discuss the importance of a bilateral investment treaty (BIT) to US-China relations, and to both the US and the Chinese economies. This discussion is part of an on-going effort by the Paulson Institute and its partners to support a high standard bilateral investment treaty between the United States and China.

Institute Chairman Hank Paulson opened the day’s discussions with an onstage conversation with Secretary Pritzker by stressing the importance of the US-China relationship in finding solutions for global challenges: “It’s hard to think of any issue that wouldn’t be solved more easily if the two countries work in a complementary fashion,” he said.

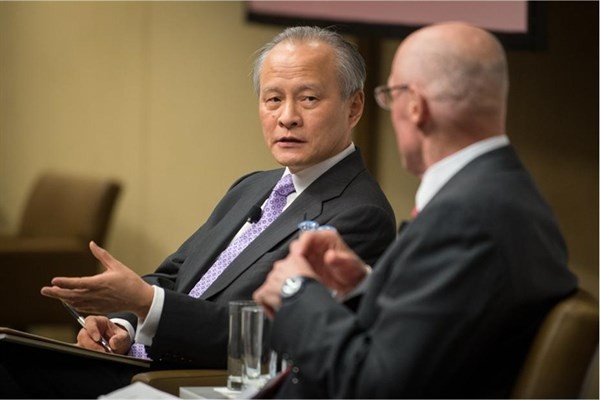

Over the course of the day-long meeting, experts and CEOs discussed China’s transition to a consumer-led economy, challenges in cross-border investment in both countries and China’s role as a global economic powerhouse. Goldman Sachs CEO Lloyd Blankfein interviewed Henry Kissinger on the evolution of US-China relations, and Institute Chairman Paulson interviewed Chinese Ambassador Cui Tiankai on the prospects for US-China relations and China’s evolving role as a world power.

In conversation with Paulson, Pritzker highlighted US efforts to streamline the process for foreign companies investing in the United States and pointed out that the United States—unlike China—does not treat foreign investors differently from domestic companies.

John Frisbie, president of the US-China Business Council, stressed that a BIT would be good because it would open Chinese markets to US companies. “Investment barriers are market access barriers,” he said. “A high-standard BIT would have enormous impact.”

The consensus was that a BIT would help the US economy both directly and indirectly—first, adding jobs in the United States by attracting greater Chinese investment in the US, and second, helping US companies prosper in their businesses in China. Given the global nature of today’s economic system, the experts agreed, US companies would benefit by increased market access in China as it allows them to expand and grow at home in the United States.

Moderating a panel discussion about Chinese investment in the United States, Paulson Institute Senior Fellow Deborah Lehr, a former US trade official who helped negotiate China’s entry into the World Trade Organization, stressed that it’s important for the United States to work with China and to support its entry and full participation in global, rules-based institutions. Institute Vice Chairman Evan Feigenbaum noted that Chinese companies are investing in the “American innovation engine to help China make changes needed in its own industries.” Such investments help create jobs in the United States and also promote more transparent, rules-based business practices back home.

Many of the US mayors attending the conference expressed enthusiasm about the promise of Chinese investments in their cities—and said that making the Chinese investors comfortable in a city or community is an important part of the process. A Paulson Institute case study about Tianjin Pipe Corporation’s billion-dollar investment in a small town in Texas makes the same point: laying out the welcome mat makes a difference.

In conclusion, all recognized that it is in the strategic interest of the United States and China to conclude a high quality BIT in a reasonable time period.