a partnership between

The Cost of Biodiversity Loss

Earth is experiencing dramatic and accelerating biodiversity loss caused by human activities. Although extinction is a natural phenomenon, scientists estimate the world is now losing species at up to 1,000 times the natural rate of one to five species per year. The abundance of mammals, birds, fish, reptiles, and amphibians has declined, on average, by 60 percent over the last four decades—the blink of an eye in evolutionary terms. If human society continues on this trajectory, we face a future where 30 to 50 percent of all species may be lost by the middle of the 21st century.

Biodiversity is essential for the health of our planet, yet it is in a sharp decline, driven mainly by human behavior. The United Nations’ Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) recently warned that humans are exploiting nature far more rapidly than it can renew itself.

As the world works to manage the impacts of the COVID-19 pandemic and restore our economies, we could easily forget the value of nature, but that would be a mistake. Research from the World Economic Forum shows that US$ 44 trillion of global GDP—around half—is highly or moderately dependent on nature. Here’s just one small example: the worldwide loss of all pollinators (including bees, butterflies, moths and other insects) would lead to a drop in annual agricultural output of about US$ 217 billion.

Although we will never be able to calculate the full value of nature, we know enough to recognize that its destruction presents profound risks to human societies, and, as with any serious risk we face, the rational response is to take out an insurance policy. In the case of biodiversity loss, the insurance policy must be a comprehensive, worldwide effort to appropriately value, protect, and restore nature.

If ever there was a chance to take out this insurance policy, it is now. Representatives from 196 parties to the UN Convention on Biological Diversity are deep in negotiations and, next year, are due to agree on a new global framework to slow and halt the decades-long sharp decline in biodiversity. The negotiators are discussing significantly increasing the number and size of terrestrial and marine protected areas, better governance of natural resources and the sectors that utilize them, more vigorous enforcement of existing laws and regulations, and, perhaps most daunting, how to pay for what is needed.

In the case of biodiversity loss, the insurance policy must be a comprehensive, worldwide effort to appropriately value, protect, and restore nature.

In the medium to long-term, we need a transformational shift in the way markets, and the discipline of economics more broadly, value nature. This won’t happen overnight and will require a clear and compelling economic case championed by strong political leaders and underpinned by broad public support.

In the meantime, in order to tackle the substantial risks of biodiversity loss, we must urgently identify and implement innovative financing and policy mechanisms that can rapidly mobilize substantial amounts of funding for nature conservation and reform harmful subsidies, such as those for agriculture, in order to reduce the amount of new finance required.

Landscape reflected | Photo credit: Harvey Locke

Landscape reflected | Photo credit: Harvey Locke

The Biodiversity Financing Gap

To address this challenge, the Paulson Institute, The Nature Conservancy, and the Cornell Atkinson Center for Sustainability at Cornell University set out the economic case for financing biodiversity and took a deep look at how much is currently spent and how much is needed annually in the next ten years to protect the most important biodiversity and the services it provides. The difference is the global biodiversity funding gap.

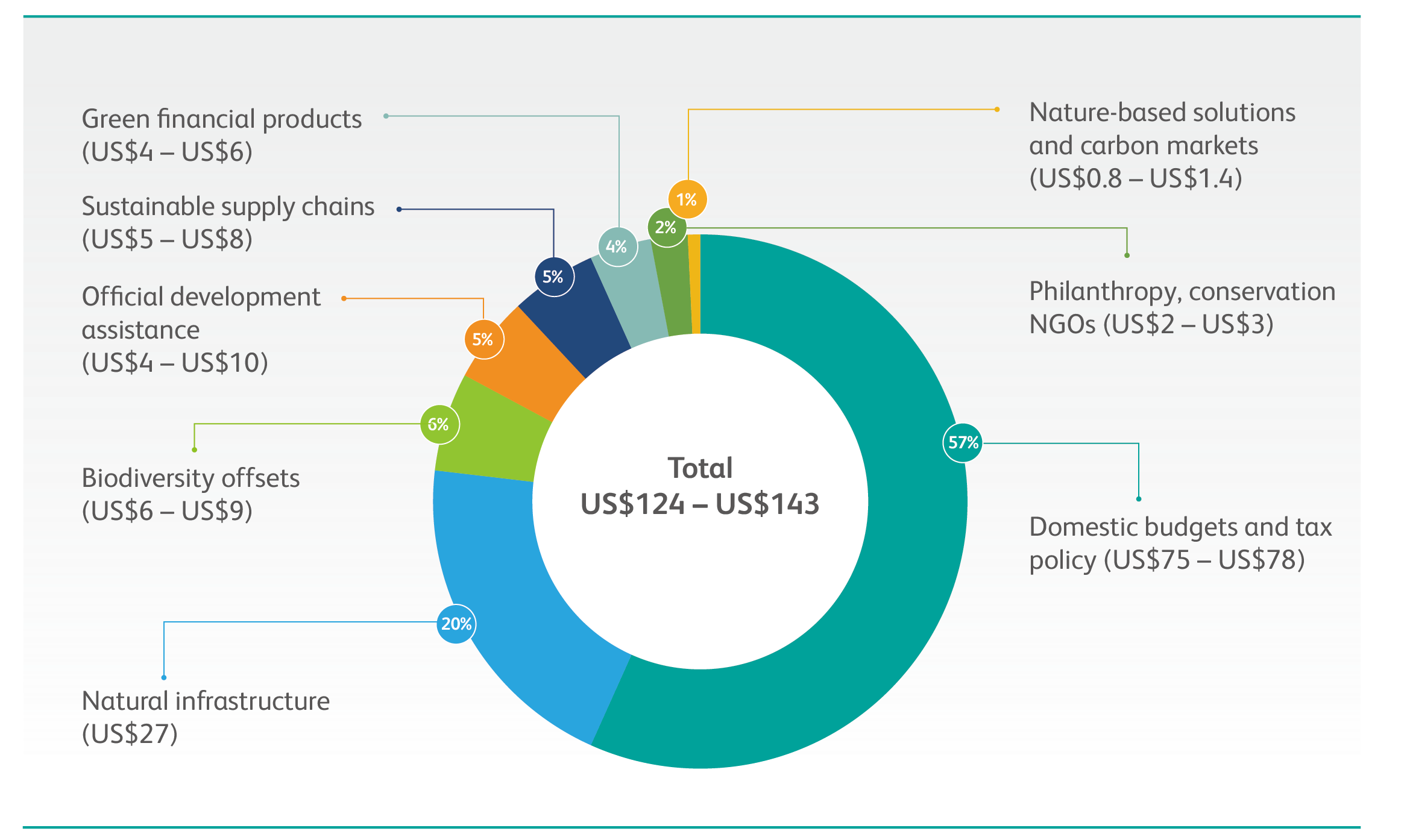

The authors estimated financial flows into global biodiversity conservation in 2019 as between US$ 124 and US$ 143 billion. This represents a near-tripling in funding since 2012 but, to put it in context, spending on agricultural, forestry, and fisheries subsidies that degrade nature is at least two to four times greater. And that does not include subsidies for fossil fuels.

Global biodiversity conservation financing in 2019: Summary of financial flows into biodiversity conservation (in 2019 US$ billions per year)

Global biodiversity conservation financing in 2019: Summary of financial flows into biodiversity conservation (in 2019 US$ billions per year)

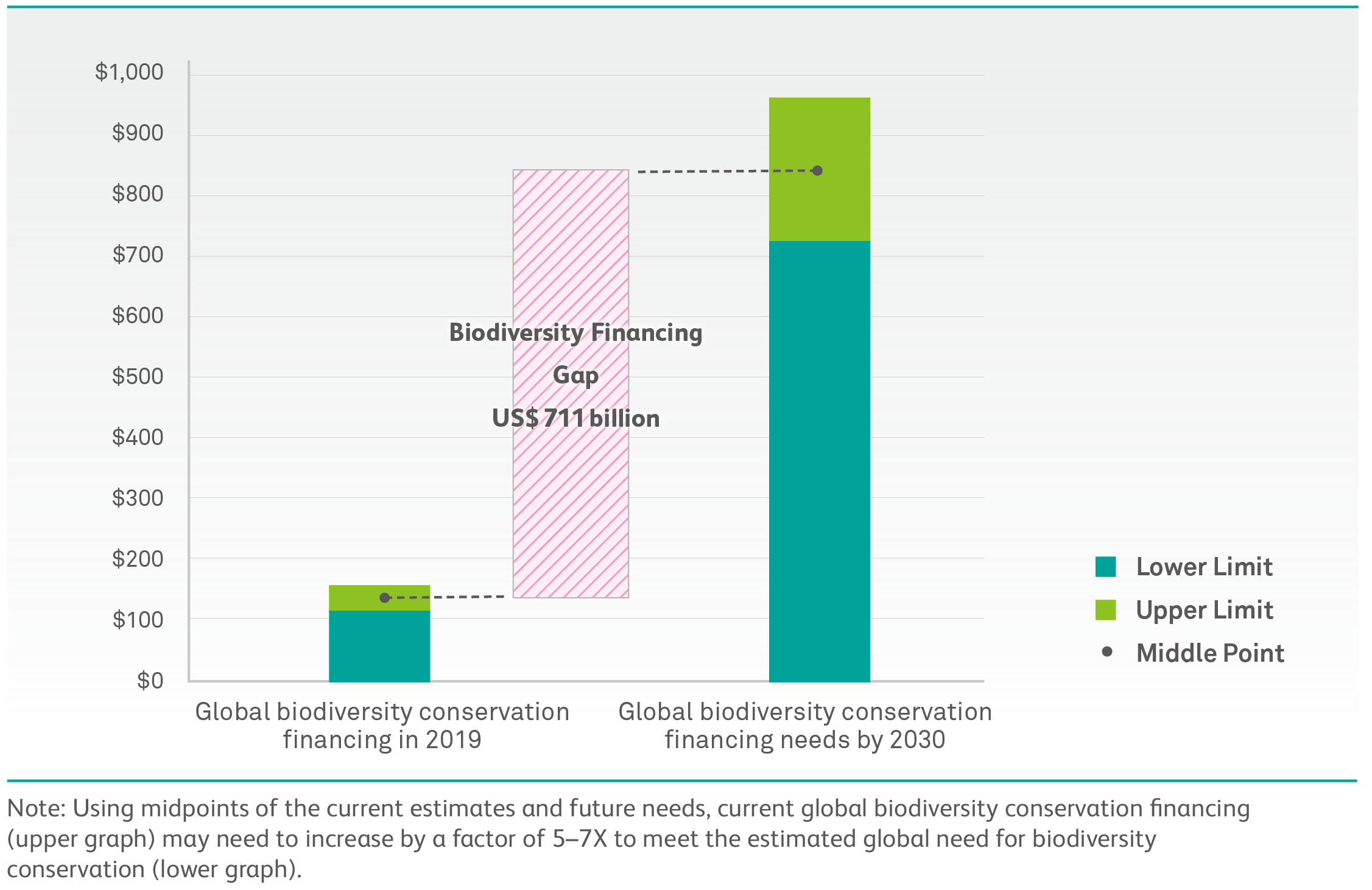

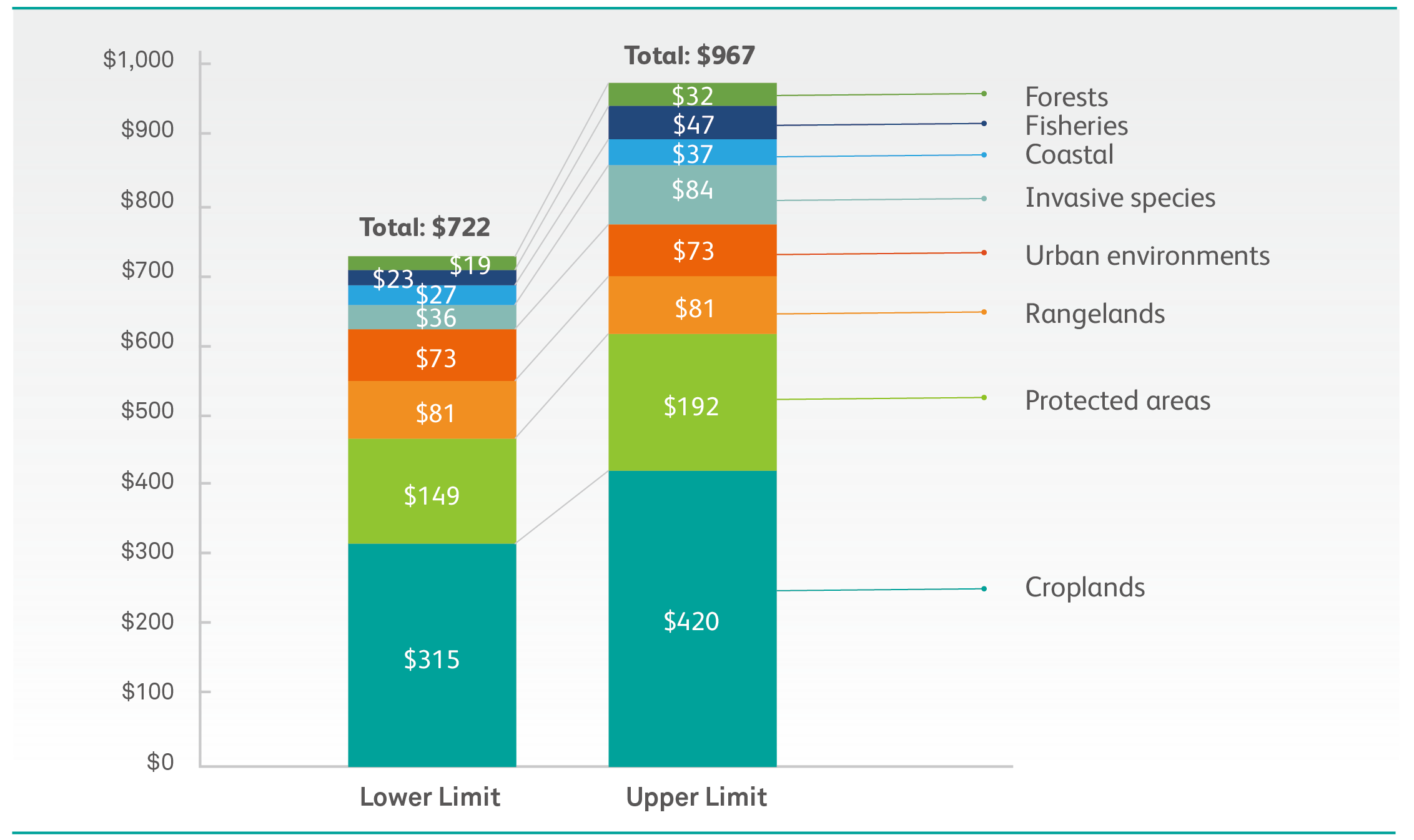

To reverse the decline in biodiversity by 2030, our analysis suggests that, globally, we need to spend between US$ 722-967 billion each year over the next ten years. That puts the biodiversity financing gap at an average US$ 711 billion or between US$ 598-824 billion per year.

Global biodiversity conservation financing compared to global biodiversity conservation needs (US$ billions)

Global biodiversity conservation financing compared to global biodiversity conservation needs (US$ billions)

Our report is among the first analyses to include the cost of shifting agriculture, infrastructure, and other high-impact sectors to more sustainable business practices. This is important because, without making substantial changes to the sectors degrading nature, the international community won’t halt biodiversity loss—no matter how significant actions are in other areas.

Global biodiversity conservation funding needs (US$ billions)

Global biodiversity conservation funding needs (US$ billions)

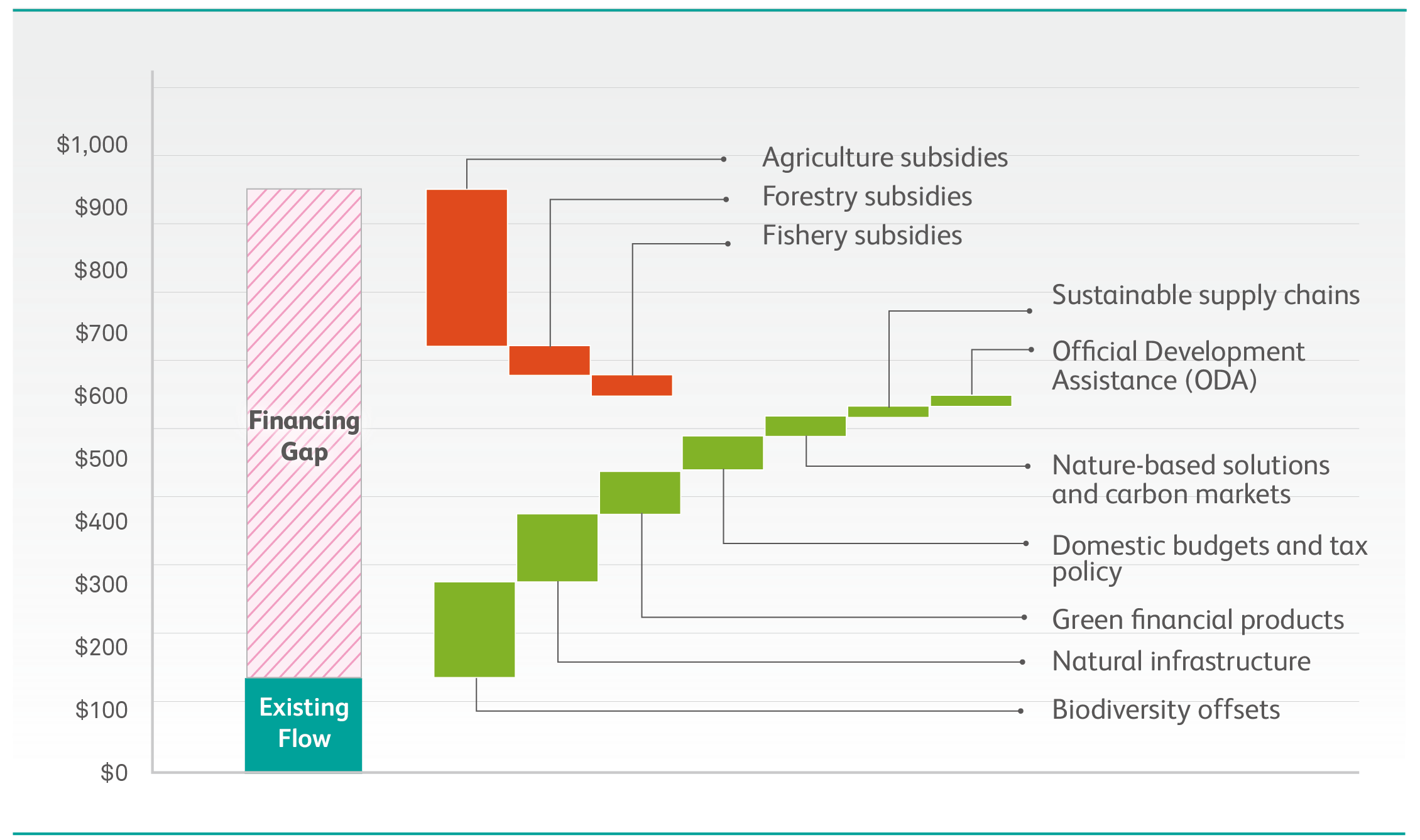

Closing the Funding Gap

As large as the funding gap might be, there is some hopeful news: the gap can be closed for less than one percent of annual global GDP or US$ 711 billion. For comparison, that’s roughly equivalent to the annual GDP of Switzerland or the state of North Carolina. This is less than the world spends on cigarettes in a year or on soft drinks. It is practically a rounding error compared with the trillions of dollars that world governments currently inject into their economies through stimulus programs or the tens of trillions in private assets around the world.

Presented here are a range of mechanisms that, if implemented at scale, could first help to reduce the future financing needed for biodiversity and, second, unlock the additional funding required. These solutions draw from myriad areas of society. Some are new financial instruments for leveraging private investment while others are policy-related changes. Many are the responsibility of governments, but some call on private corporations to transform their supply chains and investments. Importantly, everyone can make a difference, whether they are leaders in government, business, or finance, or everyday people with an interest in a healthy planet.

Egrets | Photo credit: Jianmin Wang/TNC Photo Contest 2019

Egrets | Photo credit: Jianmin Wang/TNC Photo Contest 2019

Reduce, Generate, Invest

If the biodiversity financing gap is considered as a monolithic number—over US$ 700 billion per year—it sounds daunting. But if that amount is split into a series of smaller, more manageable categories, closing the gap begins to appear within reach.

In fact, around half of this gap could be closed with no new investment. Much of what’s needed is better deployment of existing funds and smarter policy and investment choices, shifting the flow of capital away from harmful behaviors and toward outcomes that benefit nature.

Estimate of growth in financing resulting from scaling up proposed mechanisms by 2030 (in 2019 US$ billion per year)

Estimate of growth in financing resulting from scaling up proposed mechanisms by 2030 (in 2019 US$ billion per year)

The authors grouped their recommended approaches into three categories: those that reduce harm to biodiversity, those that generate new revenue, and those that catalyze increased benefits by making different use of existing funds.

-

Reduce Harmful Economic Activity [US$ 280-287 billion/year]

Reducing economic activity that harms nature, in turn, reduces the future need for funding to counteract these impacts. Changes to the way in which various sectors operate, and to the operations that governments subsidize, can go a long way toward closing the biodiversity financing gap.

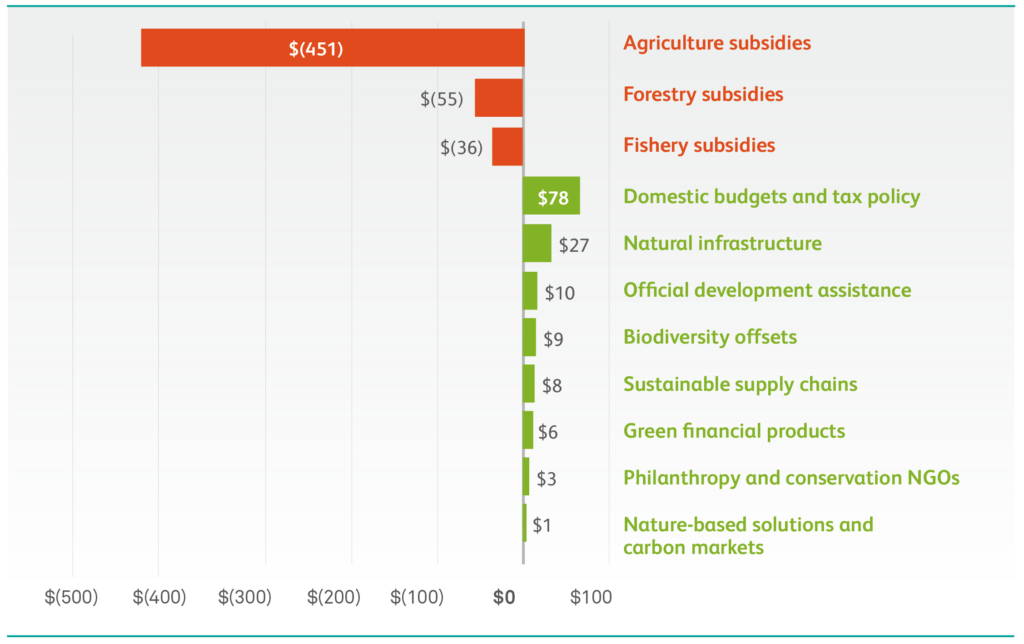

Harmful subsidies and global financial flows towards biodiversity conservation (upper estimates in 2019)

- Reform Harmful Subsidies: Subsidy reform represents the single biggest opportunity to close the funding gap. Nearly US$ 542 billion is spent each year on agricultural, fisheries, and forestry subsidies that are harmful to nature. Redirecting those payments, especially those considered most harmful to biodiversity, to incentivize more sustainable practices would benefit nature while also mitigating climate change and improving food security.

- Improve Supply Chain Sustainability: The historical impact of global supply chains on nature has been largely negative, characterized by unsustainable practices in agriculture and other sectors. However, a shift toward more responsible supply chain management practices offers an opportunity to avoid harm and even positively impact nature.

- Investment Risk Management: This involves actions taken by financial institutions to understand and manage the risks to biodiversity from their investments, many of which are becoming more established in mainstream investing. These include a number of screening tools and standards that enable investors to review risks and make informed decisions to avoid investments that may have negative impacts on biodiversity or to invest in areas that have positive biodiversity impacts.

-

Generate New Revenue [US$ 169-416 billion/year]

Even if harmful economic activity is greatly reduced, new sources of funding are still needed. Mechanisms for generating revenue include:

- Domestic Budgets and Tax Policy: Governments possess significant power to influence and direct the economy in ways that both increase certain types of revenue and discourage activities that harm nature. Examples of policies that would create new funding streams include taxes, fees, debt relief, loans, and tariffs.

- Expand Green Financial Products: Interest in sustainable investing has exploded in recent years, but investments that directly benefit nature lag behind, in quantity, investments in low-carbon infrastructure. Financial institutions can help by expanding investment opportunities in green bonds, low-interest green loans, environmental impact bonds, and other green financial products. Governments can assist by creating incentives, clear guidance, and standards for these investments.

- Expand Biodiversity Offset Mechanisms: Agriculture, infrastructure, and extractive industries that unavoidably and negatively impact nature should offset the harm they cause by carrying out impact mitigation measures or paying to restore degraded ecosystems or protect at-risk ecosystems.

-

Invest Smarter

In addition to reducing harm and generating new revenues, how existing public and private financial resources are invested must be adjusted. Governments and institutions already invest trillions of dollars in infrastructure, climate mitigation, and development assistance. With smart changes in policy, more of these investments can be directed toward those that pay dividends for nature too.

- Increase Official Development Assistance for Biodiversity: Expanded aid to biodiversity-rich recipient nations from multilateral institutions and donor nations can take the form of debt forgiveness, direct grants, and technical assistance in support of biodiversity initiatives.

- Investment in Natural Infrastructure: Reefs, forests, wetlands, and other natural systems provide habitats for wildlife while delivering important ecosystem services such as watershed and coastal protection. In some cases, natural infrastructure is more cost-effective than engineered solutions.

- Nature-Based Solutions and Carbon Markets: Protecting and restoring natural ecosystems is one of the best ways to mitigate carbon emissions. By investing in these solutions, governments can meet their climate goals and protect nature at the same time. Including emission reductions from natural landscapes in carbon markets or leveraging other financial incentives creates additional economic rationale to protect nature.

A Global Effort

Every nation, sector, and citizen of the world has a role to play in protecting the planet—humanity’s only home.

Closing the biodiversity financing gap relies heavily upon government actions. All countries must fully acknowledge that healthy economies are dependent on healthy ecosystems. Nature should be seen as a finite resource to be valued and its use sustainably managed. Equipped with a more complete understanding of the benefits of biodiversity—including nature’s role in mitigating and adapting to climate change—leaders at the highest levels of government should incorporate biodiversity into their policy, legal, and fiscal decision-making.

Meanwhile, multilateral institutions and donor countries should expand programs of bilateral and multilateral official development assistance to support less-developed nations that demonstrate clear and sustainable programs to halt biodiversity loss. Developed and emerging economy countries can also play an important role in greening supply chains through driving demand for sustainable production. Banks and financial institutions can incentivize biodiversity-enhancing efforts through green finance priorities and policies.

Recognizing that the public sector cannot provide all the finance needed, there is a potentially critical role for the private sector—the greatest source of capital. However, it is important to note that, to realize this potential, governments must put in place the right regulatory environment, smart incentives, and market structures to induce the private sector to invest.

And, ultimately, citizens can play a key role in protecting biodiversity: first, by understanding and communicating the scope of the problem and the solutions at hand, second, by changing individual consumption behavior and choosing to support and work for companies and institutions that are committed to protecting nature, and, third, in democracies, by voting for politicians who prioritize nature.

Turtle hatchling making its way to the sea | Photo credit: Carlton Ward, Jr.

Turtle hatchling making its way to the sea | Photo credit: Carlton Ward, Jr.

The Road Forward

The natural world has always served as an inspiration and resource to human societies and cultures. However, the balance has now tipped, and nature is being over-exploited. Today, not only are our lands and waters polluted and depleted, but the diversity of plant and wildlife species is in serious decline and ecosystems that provide vital services to human society are being degraded.

In 2021 there is a unique opportunity to inject momentum into the global response to the biodiversity crisis when the 15th Conference of the Parties (COP 15) to the UN Convention on Biological Diversity will take place in Kunming, China. At this meeting, governments are due to agree on a “new deal for nature” including targets to reduce and eventually halt biodiversity loss by 2030 and beyond.

Collectively, we must take action to protect our natural capital and mobilize more financial resources to secure a healthier planet.

An overarching international agreement that provides the vision and sets targets is an important element of the global response to the biodiversity crisis. However, it is not sufficient. The new deal for nature must be backed up by domestic policy, legislation, and finance that put each country on a path consistent with the agreement’s goals. Not every solution outlined here will work for every country, but governments can identify those that are most appropriate for their countries and economies. Collectively, we must take action to protect our natural capital and mobilize more financial resources to secure a healthier planet.

When we succeed, the payoff will come in the form of improved natural resilience that benefits us all: greater food, water, and economic security; a more stable climate; reduced risk of pandemics, and, not least of all, the intangible benefits nature brings to us every day. To that end, valuing nature and closing the current biodiversity financing gap is, put simply, a smart investment.

Marine biodiversity | Photo credit: Tyler Schiffman/TNC Photo Contest 2019

Marine biodiversity | Photo credit: Tyler Schiffman/TNC Photo Contest 2019

With a global virtual event on Thursday, September 17, 2020—led by Hank Paulson and a VIP panel—the Paulson Institute, The Nature Conservancy, and Cornell Atkinson Center for Sustainability launched Financing Nature.

Read more from our partners:

The Nature Conservancy

Cornell Atkinson Center for Sustainability